Ask Steve

July 19, 2024

Question from Eric: With such a wide variety of stretch films available on the market today, can I relate the price per pound I am paying to performance?

Hi, Eric,

Thanks for your question, and I will say it is THE most fundamental and critical stretch film question - period. And therefore, as you can imagine, not a simple one to answer. I want to make sure I provide you with the information you need to make an informed decision. So, let’s tackle it one step at a time.

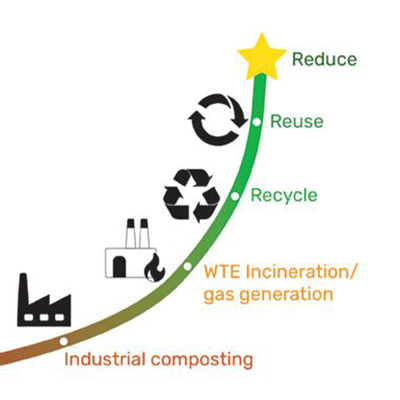

First consider all the stakeholders in your organization and the metrics their performance is measured on, because at the end of the day, they must all be satisfied and feel that their importance has not been diminished in any way. Keep in mind, an organization is like a chain, one link breaks and the entire chain fails. A lot of great ideas were abandoned because they lacked cross-functional support, so to ensure success, everyone must be a winner. Diving in a little deeper, we can see that the roles and priorities are quite different within your organization. It is almost like everyone is speaking different languages altogether. For instance, Purchasing is focused on price per unit of measure (typically by roll or by pound), an Operations Manager is focused on throughput (how many pallets per day can be produced and shipped), the Sustainability Manager is focused on source reduction and recyclability, Management and/or Sales is focused on load failures and their impact to your organization and to your customers. Each plays a critical role in the success of your organization, and at the end of the day, you are all on the same team.

Now, let’s find a common language that speaks to all the organization’s needs. I think we can agree that above all else, the job of the stretch wrap is to provide load containment for your product after it is palletized. The next step is to determine how much load containment you need. Heavy and expensive loads, or ones that are mission critical or potential environmental impact loads need the greatest containment. Light and inexpensive loads need less. We can really boil this concept down to the following statement, You are not purchasing stretch film, you are actually purchasing load containment. I can’t stress that enough, so it’s worth repeating: You are not purchasing stretch film, you are actually purchasing load containment. If you are losing hundreds of thousands of dollars due to load failures or customer chargebacks, adding $0.15 or more in cost per pallet to fix it may be a slam-dunk, no-brainer.

Building on that understanding, you should therefore concentrate on your load containment (stretch wrap) cost per pallet. THAT IS YOUR COMMON LANGUAGE. If you do that, you can more accurately evaluate stretch film cost based on achieving a set load containment standard. Choosing the stretch film that allows you to achieve your load containment standard using the least amount of film and cost per pallet will also reduce your source content. Expanding on that thought, you may apply fewer wraps, which means more production throughput (generating more revenue for your company). And finally, by meeting or exceeding your load containment standard you reduce the heavy cost of load failures and unhappy customers. It may seem elementary, but it is not that easy because it requires people to rethink how they evaluate stretch film cost.

There are wild claims about hyper-performance films, downgauging, and always someone offering today’s lowest price per pound, but if you evaluate them based on a wrapped cost per pallet, you may find that you are not getting such a good deal after all. You may find that you are applying twice the amount of the lowest cost film on the pallet, and while paying less per pound for the film, you could be paying MORE per pallet, and still have load failures. The bottom line is very simple, if you are only focused on stretch wrap price per pound and not stretch wrap cost per pallet, wrapped to meet your load containment standard, your corporate chain is broken, and everyone loses.

We study the science of load containment each, and every day, and with that knowledge, we provide market-disruptive technology solutions that have true value, so you can increase load containment, reduce your stretch film usage, reduce the number of wraps needed, and reduce stretch film COST PER PALLET. These are not just claims, they are backed up with a track record of success over many years. Everyone in your organization can be a winner! Remember, You are not purchasing stretch film, you are actually purchasing load containment.

Thanks for asking!